Stock Ideas with no Booyah

These stock ideas presented here are just that, ideas. You are responsible for the trades you make as you can lose some or all of your money. You must do your due diligence and research any stock before buying. You need to understand the risks involved before any purchase. We are not investment advisors, please consult your investment advisor before making any investment. Stock may go up in value or may go down in value. No one can predict what the stock market will do, or individual stocks. Let look at some stocks that have good technical patterns.

If you are interested in what the stock market is doing go to the Stock Market Dashboard.

Stock Idea Disclaimer

The following stock ideas are based mainly on strong chart patterns and may include a fundamental indicator. One re-occurring pattern that exists is that when a stock is breaking out it seems that shortly after the breakout (i.e. the next day or a few days later), many stocks will pull back. Rather than buying on the break out, it may be wise to wait for the following pullback to buy. We are not investment advisors, you must do your due diligence before investing in any stock.

This stock idea is (GM) presented on 9-22-17

This company is General Motors. GM is in the Automobile business. GM pays a dividend of 3.86%. GM earns $6.30 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (CPA) presented on 9-15-17

This company is COPA Holdings. COPA is in the Airline business. CPA pays a dividend of 2.24%. CPA earns $7.76 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (GILD) presented on 7-28-17

This company is Gilead Sciences Inc. GILD is in the Biotechnology business. GILD pays a dividend of 2.77%. GILD earns $9.21 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (SLF) presented on 7-14-17

This company is Sun Life Financial Inc. SLF is in the Insurance business. SLF pays a dividend of 3.5%. SLF earns $3.18 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (TSO) presented on 6-30-17

This company is Tesoro Corp. TSO is in the Oil, Gas and consumable fuels business. TSO pays a dividend of 2.36%. TSO earns $5.97 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

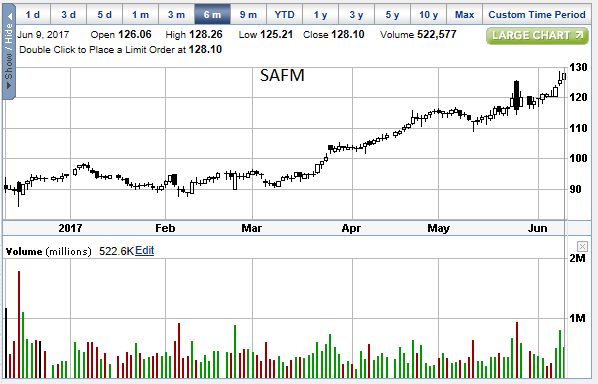

This stock idea is (SAFM) presented on 6-09-17

This company is Sanderson Farms Inc. SAFM is in the Food Products business. SAFM pays a dividend of 0.76%. SAFM earns $9.74 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (LRCX) presented on 5-19-17

This company is Lam Research Corp. LRCX is in the Semiconductor business. LRCX pays a dividend of 1.20%. LRCX earns $7.84 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

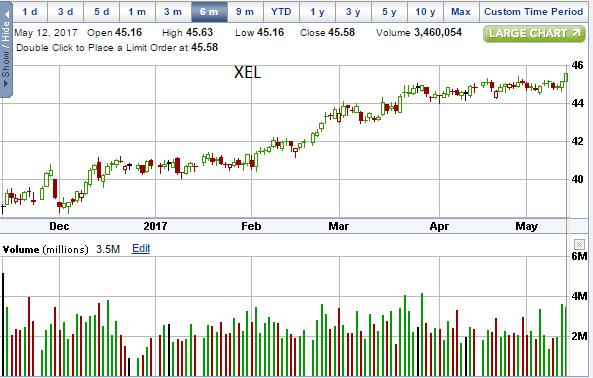

This stock idea is (XEL) presented on 5-12-17

This company is XCEL Energy. XEL is in the Energy business. XEL pays a dividend of 3.19%. XEL earns $2.20 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (SWK) presented on 5-05-17

This company is Stanley Black and Decker. SWK is in the Machinery business. SWK pays a dividend of 1.68%. SWK earns $7.82 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (BBY) presented on 4-21-17

This company is Best Buy. BBY is in the Specialty Retail business. BBY pays a dividend of 2.69%. BBY earns $3.75 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (APO) presented on 4-14-17

This company is Apollo Global Management. APO is in the Capital Markets business. APO pays a dividend of 5.54%. KLAC earns $2.10 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

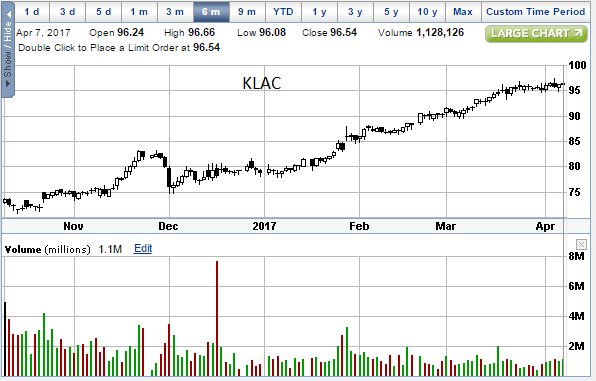

This stock idea is (KLAC) presented on 4-07-17

This company is KLA-Tencor Corp. KLAC is in the Semiconductor business. KLAC pays a dividend of 2.25%. KLAC earns $5.50 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (DRI) presented on 3-31-17

This company is Darden Resturants Inc. DRI is in the Hotel, Restaurant and Leisure business. DRI pays a dividend of 2.68%. CCL earns $3.92 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (CCL) presented on 3-24-17

This company is Carnival Corp. CCL is in the Hotel Restaurant and Leisure business. CCL pays a dividend of 2.39%. CCL earns $3.75 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

This stock idea is (HD) presented on 3-17-17

This company is Home Depot. HD is in the specialty retail business. HD pays a dividend of 2.39%. HD earns $6.45 per share. This is just an idea, you will need to research it further to see if it meets you investing objectives or check with your investment advisor.

Bond Yield Dashboard

If you are interested in what bonds are doing go to the Bond Yield Dashboard.

REITS

If you are interested in REITs go to REITs explained.

Day Trading Ideas

If you are interested in day trading, this site is recommended The Technical Trader.

Swing Trading

For other swing trading ideas (i.e. 2 weeks, 2 months and longer) check out the wizard.

Past Ideas

- BANC 3-10-17 at 20.70 (closed at 19.75 on 09-22-17 and a dividend)

- AMGN 3-03-17 at 180.20 (closed at 180.21 on 07-28-17 and a dividend)

- AIZ 2-24-17 at 98.76 (closed at 104.63 on 07-14-17 and a dividend)

- OAK 2-17-17 at 45.00 (closed at 47.80 on 06-19-17 and a dividend)

- RCL 2-10-17 at 95.84 (closed at 113.94 on 06-02-17 and a dividend)

- GLW 2-04-17 at 26.73 (closed at 29.62 on 05-16-17 and a dividend)

- GMLP 1-27-17 at 24.64 (closed at 25.36 on 02-02-17 and a dividend)

- GM 1-20-17 at 37.01 (closed at 38.22 on 03-03-17 and a dividend)

- BMO 1-13-17 at 75.01 (closed at 77.13 on 03-07-17 and a dividend)

- UTHR 1-06-17 at 146.96 (closed at 168.16 on 02-17-17)

- ORBK 12-30-16 at 33.41 (closed at 36.39 on 01-27-17)

- T 12-23-16 at 42.79 (closed at 41.68 on 03-24-17 and a dividend)

- DOW 12-16-16 at 58.41 (closed at 64.03 on 03-17-17 and a dividend)

- APO 12-09-16 at 20.86 (closed at 23.29 on 03-10-17 and a dividend)

- GATX 12-02-16 at 56.74 (closed at 64.17 on 12-20-17 and a dividend)

- GBX 11-25-16 at 38.45 (closed at 49.05 on 1-13-17 and a dividend)

- R 11-18-16 at 78.76 (closed at 84.69 on 12-08-16 and a dividend)

- PRU 11-11-16 at 97.93 (closed at 108.75 on 2-10-17 and a dividend)

- AXS 11-04-16 at 58.06 (closed at 66.66 on 2-04-17 and a dividend)

- SPR 10-28-16 at 50.19 (closed at 60.26 on 12-08-16 and a dividend)

- EXPE 10-22-16 at 127.58 (closed at 131.64.68 on 10-28-16 and a dividend)

- LUV 10-14-16 at 41.32 (closed at 51.68 on 1-11-17 and a dividend)

- AHL 10-07-16 at 49.10 (closed at 55.80 on 1-06-17 and a dividend)

- ZBRA 9-30-16 at 69.61 (closed at 87.05 on 12-27-16 and a dividend)

- MET 9-23-16 at 44.52 (closed at 57.28 on 12-15-16 and a dividend)

- INTC 9-16-16 at 37.67 (closed at 36.31 on 12-16-16 and a dividend)

- TGP 9-09-16 at 15.22 (inner day high of 16.94 on 10-04-16 and a dividend)

- LNC 9-02-16 at 48.06 (closed at 65.12 on 12-02-16 and a dividend)

- LPLA 8-26-16 at 29.24 (closed at 40.71 on 11-25-16 and a dividend)

- MS 8-19-16 at 30.55 (closed at 40.43 on 11-18-16 and a dividend)

- ESNT 8-12-16 at 25.85 (closed at 29.63 on 11-10-16)

- TSM 8-05-16 at 28.79 (closed at 31.55 on 10-25-16 and a 3.1% dividend)

- TRN 7-29-16 at 23.21 (closed at 25.05 on 8-23-16 and a dividend)

- SKYW 7-22-16 at 23.02 (closed at 30.10 on 8-21-16 and a dividend)

- EVH 7-15-16 at 23.28 (closed at 26.69 on 8-11-16)

- LGIH 7-08-16 at 34.01 (closed at 39.469 on 9-07-16)

- VZ 7-01-16 at 56.23 (closed at 51.89 on 9-30-16 and a 4.3% dividend)

- ED 6-24-16 at 78.41 (closed at 81.67 on 7-05-16 and a 3.4% dividend)

- WM 6-17-16 at 62.65 (reached 70.50 intra day on 7-05-16 and a dividend)

- UNH 6-10-16 at 139.24 (closed at 143.20 on 7-29-16 and a dividend)

- TSE 6-03-16 at 48.43 (closed at 59.57 on 8-29-16 and a dividend)

- CB 5-27-16 at 127.22 (closed at 130.71 on 6-30-16 and a dividend)

- LCI 5-20-16 at 22.50 (closed at 32.55 on 8-05-16)

- FBSH 5-20-16 at 57.68 (closed at 63.89 on 8-12-16 and a dividend)

- BAX 5-13-16 at 45.52 (closed at 48.52 on 8-01-16 and a dividend)

- DGX 5-06-16 at 75.78 (closed at 86.36 on 7-29-16 and a dividend)

- HDS 4-29-16 at 34.28 (closed at 36.66 on 7-14-16)

- KEP 4-22-16 at 25.88 (closed at 25.94 on 7-08-16 and a 5% dividend)

- SWK 4-16-16 at 108.79 (closed at 115.05 on 6-23-16 and a dividend)

- SUPN 4-09-16 at 16.72 (closed at 19.74 on 6-02-16)

- HD 4-01-16 at 134.85 (closed at 137.51 on 5-10-16 and a dividend)

- KBH 3-24-16 at 13.93 (closed at 14.77 on 4-20-16)

- IBM 3-18-16 at 147.09 (closed at 152.52 on 4-01-16)

- WHR 3-11-16 at 164.70 (closed at 190.15 on 4-19-16)

- UTX 3-04-16 at 97.00 (closed at 105.89 on 4-27-16)

- WCN 2-26-16 at 62.79 (closed at 69.74 on 5-13-16)

- GPC 2-19-16 at 92.07 (closed at 98.41 on 3-17-16)

- NEE 2-13-16 at 111.67 (closed at 118.50 on 3-18-16)

- EXC 2-05-16 at 32.90 (closed at 35.86 on 3-31-16)

- STZ 1-29-16 at 152.36 (closed at 160.68 on 4-01-16)

- AWK 1-22-16 at 62.44 (closed at 70.38 on 4-8-16)

- CMG 1-16-16 at 475.94 (closed at 533.69 on 3-7-16)

- CNC 12-31-15 at 65.81 (closed at 63.76 on 3-24-16)

- CSIQ 12-24-15 at 29.33 (closed at 20.54 on 3-18-16)

- PSA 12-18-15 at 248.74 (closed at 274.05 on 4-08-16 and a dividend)

- ORBK 12-11-15 at 22.29 (closed at 23.47 on 3-18-16)

- SCHW 12-05-15 at 34.51 (closed at 28.37 on 3-18-16)

- DOW 11-28-15 at 52.01 (closed at 56.97 on 12-09-15)

- VRSN 11-21-15 at 90.31 (closed at 93.12 on 12-04-15)

- HII 11-13-15 at 127.49 (closed at 134.52 on 11-23-15)

- AAPL 11-06-15 at 120.06 (got to 123.82 on 11-04-15)

- BAK 10-31-15 at 11.15 (closed at 15.01 12-28-15)

- MO 10-23-15 at 61.05 (closed at 62.01 3-11-16 w/ 3.64% dividend)

- COR 10-16-15 at 56.80 (closed at 60.10 on 11-23-15 and a dividend)

- AWK 10-16-15 at 58.38 (closed at 59.83 on 12-24-15)

- FLTX 10-09-15 at 55.84 (closed at 61.75 on 12-1-15)

- NI 10-03-15 at 19.05 (closed at 19.83 on 11-20-15)

- PCG 9-26-15 at 52.92 (traded at 54.99 on 10-21-15)

- BBY 9-19-15 at 37.53 (traded at 31.48 on 11-27-15)

- LJPC 9-11-15 at 39.36 (traded at 42.50 on 9-25-15 then all biotechs pulled back)

- IQNT 9-11-15 at 21.71 (closed at 28.79 on 12-24-15)

- LE 9-04-15 at 28.31 (closed at 24.06 on 11-06-15)

- LGIH 9-04-15 at 26.94 (closed at 32.69 on 10-12-15)

- BEAT 8-28-15 at 14.67 (traded at 16.68 on 9-14-15 then all biotechs pulled back)

- EIX 8-21-15 at 62.14 (closed at 64.28 on 10-16-15 with a 2.63% dividend)

- VLO 8-14-15 at 68.12 (closed at 73.02 on 11-24-15)

- TE 8-09-15 at 22.14 (traded at 26.59 on 9-9-15)

- OC 7-31-15 at 44.85 (traded at 47.90 on 8-18-15)

- XON 7-25-15 at 56.86 (traded at 69.45 on 8-6-15)

- AMBA 7-17-15 at 111.12 (traded at 129.19 on 7-23-15)

- AKBA 7-17-15 at 10.80 (traded at 14.20 on 9-9-15)

- SUPN 7-11-15 at 18.07 (traded at 23.30 on 8-5-15)

- FINL 7-02-15 at 27.92 (got as high as 29.05 before the market sell off)

- KBH 6-26-15 at 17.32 (pulled back and closed at $15.03 8-21-15)

- HIMX 6-20-15 at 8.58 (closed at $7.25 on 9-04-15)

- VOYA 6-13-15 at 47.27 (ran into resistance a $48, trading at 45.11 on 8-07-15)

- EBAY on 6-05-15 at 26.61 (traded at 29.35 on 7-20-15)

- EXAS on 6-05-15 at 28.47 (ran up to 32.85 in 2 weeks, before pulling back)

- ADXS on 5-31-15 at 25.16 (closed at 28.77 on 6-01-15, then pulled back)

- HZNP on 5-23-15 at 32.05 (on 7-20-15 closed at 38.31)

- CI on 5-23-15 at 135.86 (on 7-17-15 closed at 153.41)

- IDTI on 5-23-15 at 22.62 (rallied 2 points before pulling back)

- MGA on 5-15-15 at 55.65 (within 2 weeks made it to 59.28)

- SINA on 5-09-15 at 43.39 (the within the next 6 weeks pulled back to $40 then moved to 60.94)

- HA on 5-03-15 at 23.95 (closed at 34.84 on 10-23-15, still looks good on a pullback)

- GE on 4-11-15 at 28.51 (closed 29.51 on 10-23-15 and a 3% dividend)

- ALJ on 4-05-15 at 16.69 (closed at 21 on 8-6-15)

- TOL on 3-27-15 at 39.22 (traded at 42.09 on 8-18-15)

- JBLU on 3-20-15 at 19.48 (closed at 23.30 on 8-07-15)

- LEAF on 3-10-15 at 48.20 (3-23-15 closed at 53.83)

The Booyah Guy

If you landed on this page by accident and you were looking for some real Booyah click here for Cramer.