Reits Categories Explained

Real Estate Investment Trusts (REITS) are investments instruments that invest in real estate, directly through properties they own or through mortgages secured by property. REITs are required to pay 90% of taxable income back to the shareholders in the form of dividends. Some of the advantages of REITs is they are highly liquid, provide an income through dividend and like stock can increase in value. Some of the disadvantages are they can lose value, and if not held for a year and a day profits can be taxed at a higher rate.

There are two classes of REITs one is traded and the other is non-traded. Traded REITs can be in the form of a mutual fund, or an ETF. ETF can be traded like a stock anytime within a session or Pre-market or After-market. Mutual funds are bought and sold at the end of the day at the closing price.

A 2012 study by the University of Texas at Austin and BlueVault Partners and cited in a Forbes article, found that generally, non-traded and traded REITS perform about the same until fees are taken into account. Generally non-traded REITS under-perform their traded counter part due to management fees and in some cases front loaded fees upon purchase. In addition some non-traded REITs must be held for several years, since there are limited secondary markets.

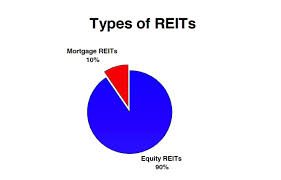

There are three types of REITs based on their investment holdings, equity REITs, Mortgage REITs and Hybrid REITs. Equity REITs usually own and manage income-producing real estate. Mortgage REITs, typically do not own real estate, but instead loan and hold mortgages on different types of real estate. Mortgage REITs manage their interest rate and credit risks though derivatives and other hedging strategies. Hybrid REITs use a combination of both mortgage and equity REIT strategies for investing. There are several rules and regulations that govern publicly traded REITs by the Security Exchange Commission SEC.

Equity REITs can be broken down further based on what types of real estate they own.

Generally you have four categories of investment.

Healthcare

Healthcare REITs invest in real estate used by hospitals, medical centers, nursing facilities and retirement homes. Healthcare REITs success is dependent on the steady occupancy by the healthcare industry. As long as the pulse of the healthcare system is strong Healthcare REITs should be strong too.

Residential

Residential REITs own and manage multi-family rental units. The markets these REITs tend to invest in are usually in markets where the affordability of housing is low, such as in large urban centers.

Office

Office REITs invest in office building. These REITs are dependent on the underlying economy. Is the economy strong or weak? Is unemployment high or low? Is this economy strong in some areas of the country but weak in others? What geographical areas does this REIT invent in?

Retail

Retail REITs invests in the buildings occupied by retail stores, like shopping malls, strip center and freestanding retail buildings. The health of this type of REIT is based on the health of the retail industry. Look around you where you live are retail buildings occupied or vacant? Is this a local trend or trend on a larger scale? What is the outlook for retail sector in the future?

If you are looking to invest in publicly traded REITs consider the fees for holding these REITs, high expenses will tend to erode your return. Also consider dividends, some will be higher than others. Don’t just invent in the REIT with the highest yield, as this may be unsustainable over time, compare the rate of return with the income per share. Is the dividend higher than the income per share? Also look at their future guidance, are there revenues growing or shrinking? Consider your investment timeline, how long are you investing for? If you are investing for longer term, the underlying fundamentals of the company are very important. If you are investing for shorter term than the technical aspect of the REITs are important, so it is worth taking a look that the chart too. Is the chart in an up trend or down trend? You don’t have to have a master in mathematics to observe trends in price graphs. Do your homework.

Here are some REIT ideas updated on 5-06-16

Recently some REITs and ETF investing have returned +20% in just the last 3 months. You may want to invest some of your portfolio in REITs. A few REITs you may want to look at REET, VNQ, KBWY, WREI

Before making any investment in REITs do your due diligence and perform enough research so you understand the risks and tax consequences involved, and always consult with your investment advisor.

For more all about REITs read: investing in REITs