By Susanne Dwyer

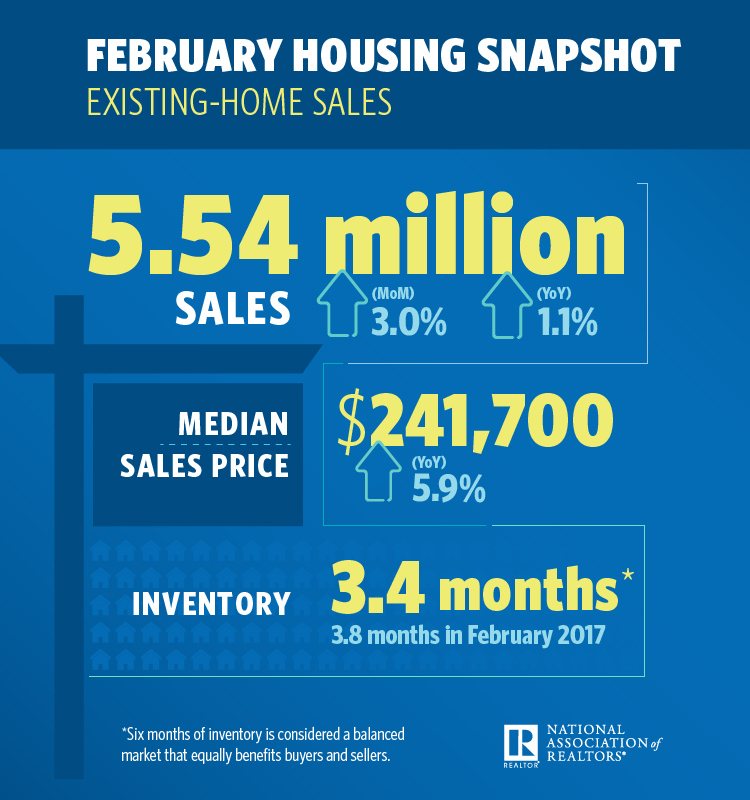

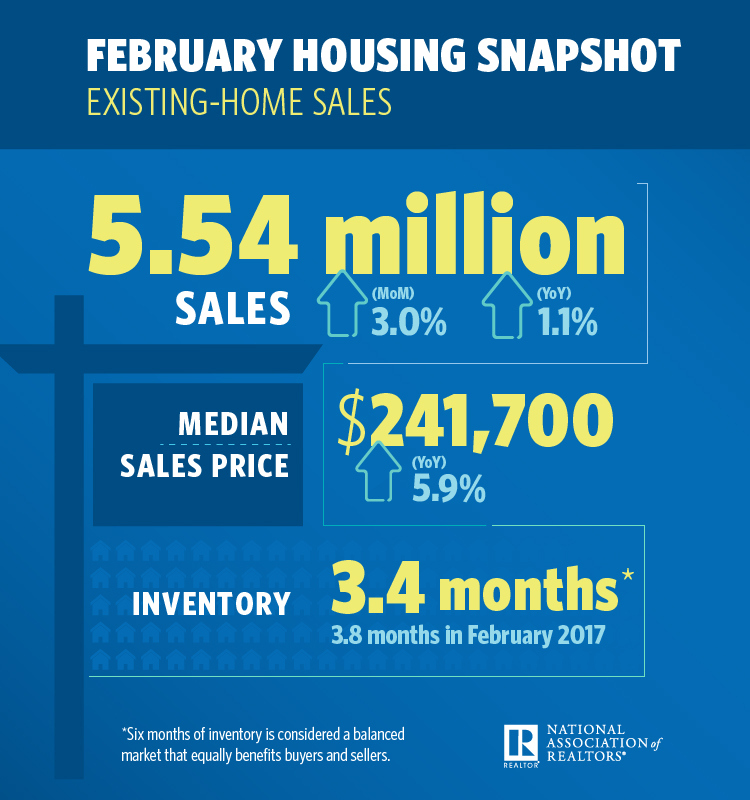

Existing-home sales in February rallied, bouncing back from a slog at the start of the year, the National Association of REALTORS® (NAR) reports. Sales increased 3 percent to 5.54 million, marking a 1.1 percent increase from one year prior.

Inventory increased, as well, 4.6 percent to 1.59 million, but remained 8.1 percent lower than one year prior.

“A big jump in existing sales in the South and West last month helped the housing market recover from a two-month sales slump,” says Lawrence Yun, chief economist at NAR. “The very healthy U.S. economy and labor market are creating a sizeable interest in buying a home in early 2018; however, even as seasonal inventory gains helped boost sales last month, home prices—especially in the West—shot up considerably. Affordability continues to be a pressing issue because new and existing housing supply is still severely subpar.”

Currently, inventory is at a 3.4-month supply. Existing homes averaged 37 days on market in February, four days less than one year prior. All told, 46 percent of homes sold were on the market for less than one month.

The metropolitan areas with the fewest days on market and most realtor.com® views in February, according to realtor.com’s Market Hotness Index, were San Francisco-Oakland-Hayward, Calif.; Midland, Texas; Vallejo-Fairfield, Calif.; San Jose-Sunnyvale-Santa Clara, Calif.; and Sacramento-Roseville-Arden-Arcade, Calif.

The median existing-home price for all types of houses (single-family, condo, co-op and townhome) was $241,700, a 5.9 percent increase from one year prior. The median price of an existing single-family home was $243,400, while the median price for an existing condo was $227,300.

Existing-home sales in the single-family space came in at 4.96 million in February, a 4.2 percent increase from 4.76 million in January and a 1.8 percent increase from 4.87 million one year prior. Existing-condo and -co-op sales, however, came in at 580,000, a 6.5 percent decrease from January and a 4.9 percent decrease from one year prior.

Twenty-four percent of existing-home sales in February were all-cash, with 15 percent by individual investors. Four percent were distressed.

Two of the country’s major regions had higher sales, rising 5.5 percent to 2.41 million in the South, with a median price of $215,700; and 11.4 percent to 1.27 million in the West, with a median price of $370,600. The Midwest and Northeast had reduced sales, falling 2.4 percent to 1.22 million in the Midwest, with a median price of $179,400; and 12.3 percent to 640,000 in the Northeast, with a median price of $258,900.

“The unseasonably cold weather to start the year muted pending sales in the Northeast and Midwest in January and ultimately led to their sales retreat last month,” Yun says. “Looking ahead, several markets in the Northeast will likely see even more temporary disruptions from the large winter storms that have occurred in March.”

First-time homebuyers comprised 29 percent of existing-home sales in February, unchanged from January.

“REALTORS® in several markets note that entry-level homes for first-timers are hard to come by, which is contributing to their underperforming share of overall sales to start the

From:: Finance and Economy