With the downturn long past, housing has gained its lost value—$9 trillion, according to a new report by Zillow. How the recovery has shaken out, however, is telling.

“A decade after the financial crisis, the scars of the housing bust are still with us,” says Aaron Terrazas, senior economist at Zillow. “The gap between the metros with the strongest and weakest housing market recoveries is as wide as it has ever been.”

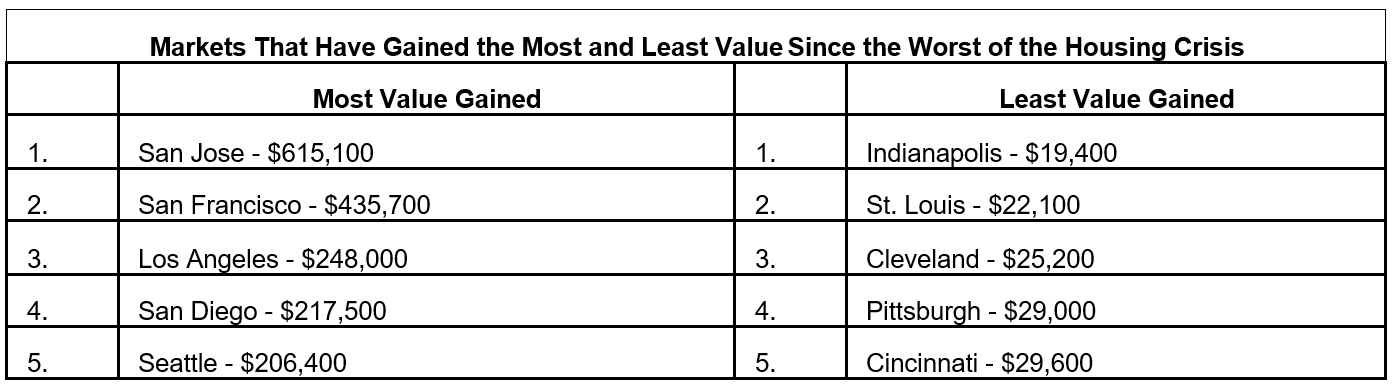

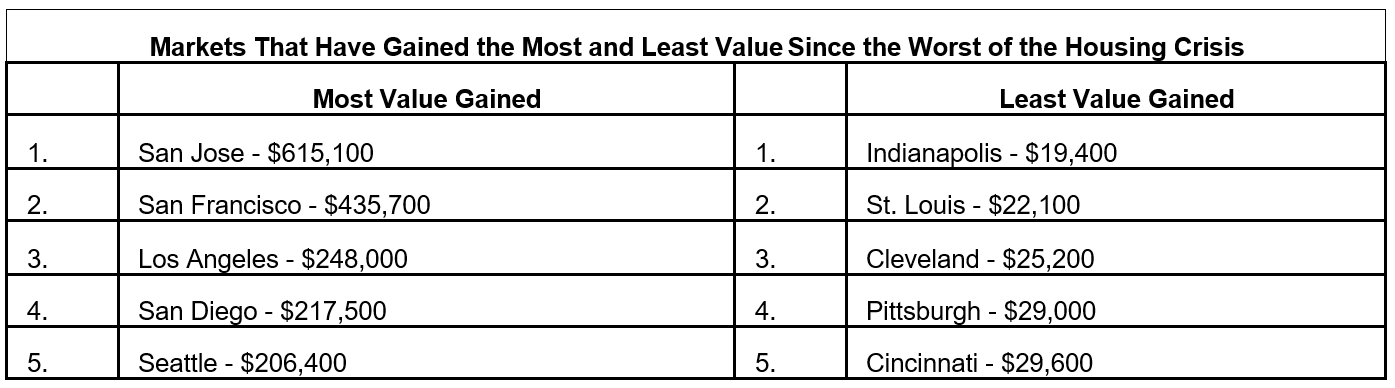

How much markets have recouped varies wildly, the report reveals. The biggest gains are out West: homes in the San Jose, Calif., metropolitan area are worth $615,100 more than they were 10 years ago; homes in the San Francisco metro area, likewise, are worth $435,700 more. In areas like Indianapolis, however, appreciation has been considerably less. The average falls somewhere in the middle: $55,200.

“The California Bay Area’s housing recovery stands out when compared to other markets that saw similar home value appreciation because it has more than regained all of its lost value,” Terrazas says. “Strong, high-paying job markets and persistently limited inventory sent prices skyrocketing, leading to the Bay Area having the most valuable housing markets in the country.”

How the 10 largest metro areas have recovered:

For more information, please visit www.zillow.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

The post Housing Is Recouping Value Unevenly: Report appeared first on RISMedia.

From:: Real Estate News